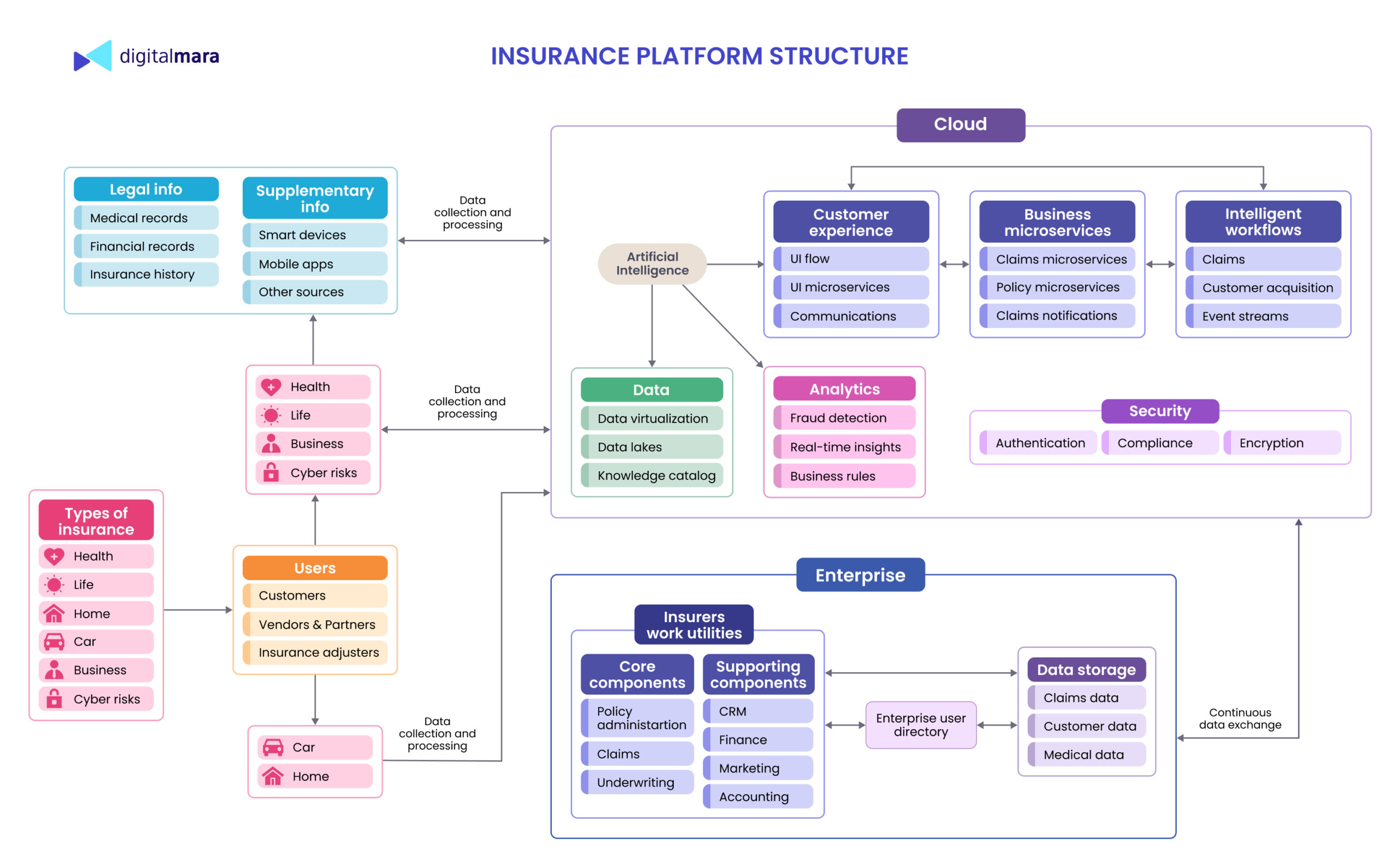

Insurance is a complex ecosystem encompassing many elements and operations that require constant coordination and management. In addition, insurers must process a large amount of data received from customers, banks, medical institutions, various smart devices, etc. Legacy software systems can hinder the effective implementation of these processes. IT modernization, on the other hand, can enhance security, accuracy, performance and the customer experience. DigitalMara has observed the insurance platform structure and studied technologies for insurance projects development.

Digitalization in the insurance industry is focused mainly on improving operational activities and enhancing the customer experience. Companies are shifting from a policy-centric to a customer-centric approach, by digitalizing their data, products, processes, and operational models. Today, that means implementing data lakes, MDM (mobile device management) projects, asset management systems, automation, advanced CRM applications, straight-through data processing and self-service opportunities.

Customers want to have a fully personalized digital experience with their insurance products, which means providing easy access to guides, services and payments at any time and from any place. Insurers seeking to modernize their systems will want to consider omnichannel solutions, risk management services, updated insurance models and lifestyle apps. But a large number of insurance companies still don’t even have mobile applications, or apps that are very basic.

There are several important factors to pay attention to when developing software solutions for insurance:

- Insurers are dealing with massive amounts of insurance data with high update frequency and from different sources. They need advanced data management tools to automate manual underwriting, eliminate errors and inefficiencies in claims handling, and use predictive analytics to improve processes.

- The insurance industry has high standards for data security and privacy. Security breaches directly affect the credibility of the company and can lead to lawsuits. Updated technologies can help in maintaining proper data governance and cyber security protocols.

- Digital modernization concerns all aspects of an insurer’s activities, and achieving improved profitability, agility, and performance can be challenging. Migrating to a cloud environment and automating workflows are some basic steps on this path.

- The emergence of new risk profiles, such as usage-based insurance and cyber risks insurance, present new challenges. Technologies can be used to arrive at more accurate risk assessments and to update risk models.

Transforming legacy systems for insurers

In sticking to legacy systems, insurance companies may face high maintenance costs, technical limitations, data losses, lower performance, and unsupported platforms or applications. All these obstacles can have a negative impact on the brand image and customer experience. While customers expect to get digital solutions, customized offerings and fast responses, legacy infrastructures are neither agile nor scalable enough to support these needs.

The traditional core insurance system consists of the policy administration system (PAS), claims and billing, with an old interface that is often difficult to use for both agents and clients. This makes it harder to conduct key operations, from billing and claims to reporting and analysis. Manual data entry leads to additional errors. Legacy insurance systems are missing proper CRM, B2B, and B2C portals, and business intelligence parts.

Many insurers faced with these issues recognize the need to rebuild their core systems and transform their overall business model. There are several approaches to modernization: modifying the system’s functionality and structure, building a proprietary platform, or buying a standard software package. The choice depends on the state and stability of the legacy system and resources available.

An insurance platform structure includes:

- Components for process automation

- Data storage, analysis and governance

- Third-party integrations

- Security layer

- Connectivity with partners (utilities, hotels, credit agencies, medical providers, payers, cars, homes, etc.)

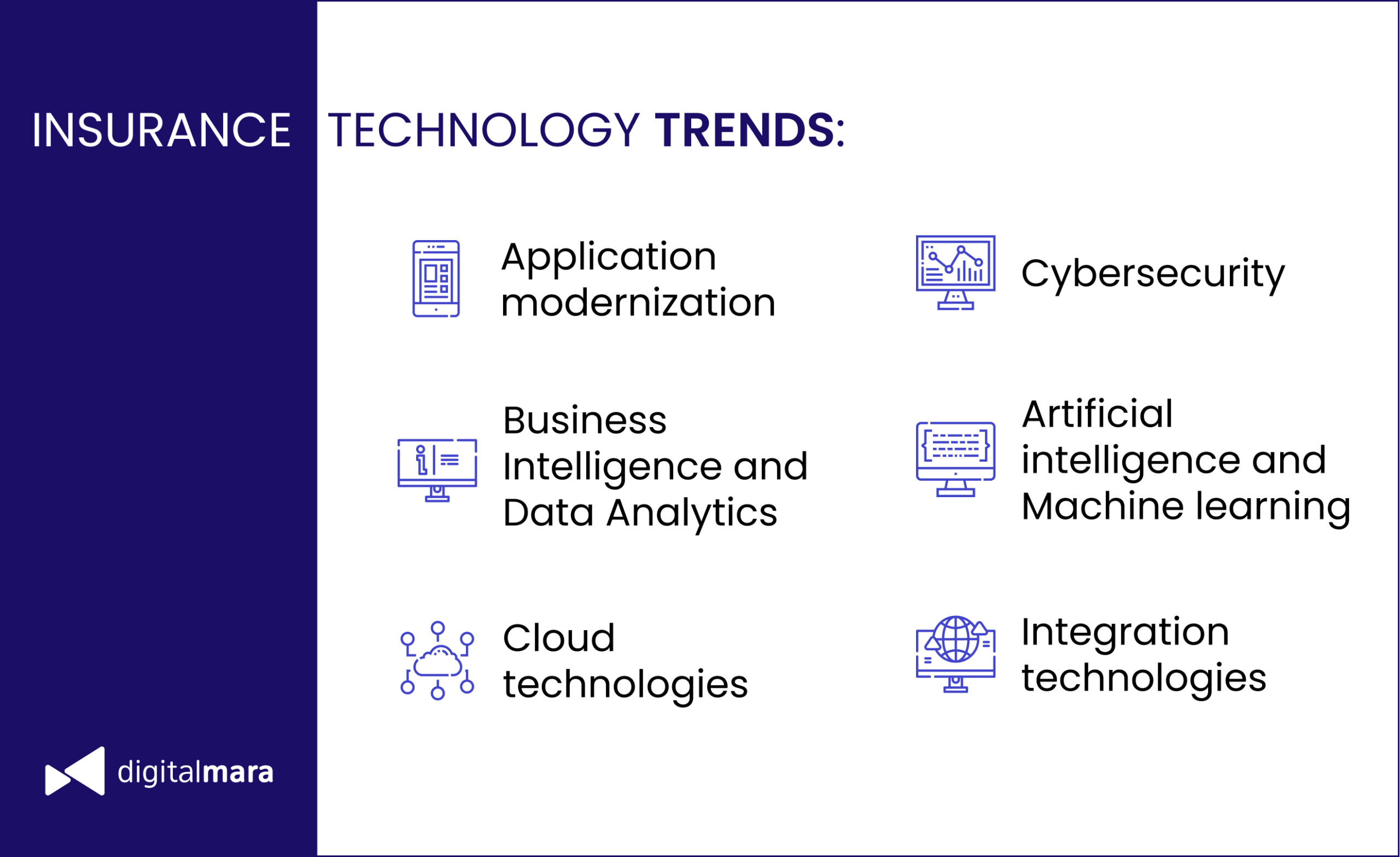

Technologies for insurance development

Working with these technologies and implementing solutions based on them makes it possible to lower costs and risks across core operations, accelerate the development of new products and enhance the customer experience. Examples include advanced data analytics, automated workflows, AI-based chatbots, connected IoT devices and much more.

- APIs and Integrations

These tools are capable of streamlining procedures, increasing processing speeds, improving accuracy, and opening new opportunities for digitalization. Using APIs, companies can launch new products and services faster, create new digital experiences and rebuild business models. They can help to deal with large data systems, give quick access to information, and reduce the friction that arises between parties who turn to different systems for information.

Insurers use data from various trackers, sensors and wearable devices to determine the optimal insurance system and parameters for insured events, when conducting investigations and monitoring. Integration with these devices derives via the API. And don’t forget about third-party applications and services and chatbots.

- Cloud technologies

Cloud tools provide better asset utilization, process automation, fraud detection, risk assessment, more flexible operating models, better customer service and regulatory compliance. They also enhance efficiency, scalability, durability and allow the system to process and use large amounts of data, for example thousands of claims.

In the cloud, new features, functions and products can be more quickly developed, tested, and launched. Insurers employing cloud technologies gain opportunities, such as providing customers with omnichannel experiences and developing a diverse portfolio of integrated services. Some examples of cloud solutions are cloud-based policy administration platforms, record-keeping and underwriting solutions, intelligent claims processing, and others.

- Cybersecurity (data security)

Clients provide an insurance company with a large amount of information, including personal and contact information, financial and even health details, all of which insurers must store and manage reliably and securely. Client portals, financial transactions, applications and data warehouses are all subject to cyber threats. Insurers need comprehensive security solutions that work with all kinds of data, within multiple operating systems and environments, embedded in their software and applications. Standard security measures include risk assessment, secure access and data encryption, user activity and third-party risks monitoring.

- Artificial Intelligence and Machine Learning

AI has big potential in the insurance industry and can be used in a wide range of operations and everyday activities. Technology helps to reduce human error at all stages and make processes more accurate, efficient and faster. Here are some use cases for AI and ML:

- predictive analytics,

- risk assessment,

- fraud detection,

- automated interactions (advanced voice responses, chatbots and self-service tools).

Insurers can provide better and more streamlined customer service, thanks to simpler and more streamlined processing of claims and underwriting.

- Business Intelligence and Data Analytics

The volume of generated customer data is constantly increasing, presenting both a problem and an opportunity for insurers. Proper data analytics helps a company make better, data-driven and well-informed business decisions, reduce fraud, mitigate risks and improve their offerings and services, as well as enhance customer experience, underwriting, and claims handling.

Insurers can collect data from internal and external sources, like telematics, agent interactions, customer interactions, wearable devices, smart homes, web browsing data and social media, and thus better predict and understand customer behavior, as well as pinpoint important events for their clients such as dismissal and retirement. Insurance companies need tools to efficiently store, use and manage all the data. If scattered across different systems and not visualized, data can end up lost and useless.

Insurance industry compliance

Insurers have to obey GDPR and other laws specific to countries and regions. Those who are working with the health data of customers need to comply with HIPAA requirements. Transparency is also crucial for insurance companies. Strict compliance with the requirements of the industry should be an essential part of everyday business practices, so clients and regulators can trust that the company adheres to ethical practices.

Insurance companies must pay careful attention to issues of data security and privacy, case and complaint management, and fraud management systems. Any breach or malfunction carries not only regulatory consequences, but also the possibility of inflicting damage on customers. Regulatory compliance and risk management for insurance companies means following comprehensive Know Your Customer (KYC) standards, as well as impeccable Anti-Money Laundering (AML) and anti-corruption practices. Cloud-based risk and security assessment systems can help assess the likelihood of risk and mitigate potential damage.

Final words

Insurers need to be exceptionally flexible to adapt to changing conditions and external factors. It is impossible to achieve this without introducing new technologies and processes.

DigitalMara can be your reliable partner on this important move. Our team can build smooth web and mobile applications for various insurance needs, including developing from scratch, upgrading legacy code, or adding new features into existing applications.