Over the past decade, FinTech has changed the financial ecosystem thanks to many innovations and a customer-centric approach. Technologies have allowed the industry to reshape certain areas of financial services and empower financial inclusion. People like using their smartphones for banking, investing, payments, lending and more, and expect to have robust FinTech solutions. According to Statista, the number of users in the digital payments market is expected to reach 5.48 billion by 2027. DigitalMara has collected some practical tips and information on technologies for building effective FinTech mobile apps.

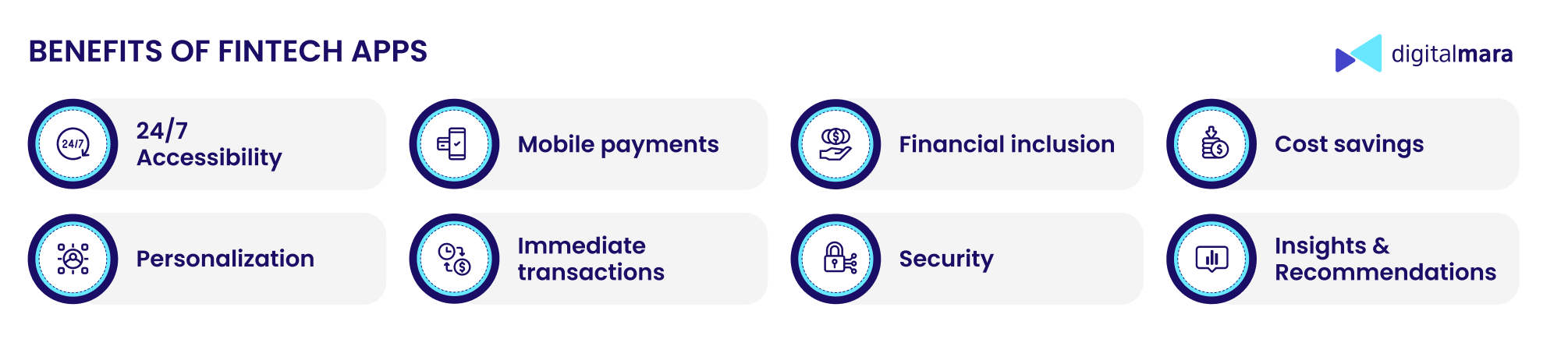

- FinTech apps bring speed and convenience. Users get round-the-clock access to financial services and the opportunity to manage their finances and process financial transactions on their mobile devices.

- FinTech apps minimize the need for extensive paperwork, allowing users to submit online applications and to upload, sign, and store documents in digital format.

- Fees are often lower compared to traditional financial institutions, as automation and digital processes reduce operational costs.

- FinTech apps provide easy and convenient access to financial markets and investment opportunities. In this way, any user can buy or sell stocks and support businesses and initiatives.

- Thanks to enhanced data analytics, users get insights on their spending habits, investment performance, and overall financial health. AI algorithms analyze user behavior to offer personalized financial predictions and recommendations.

- Worth mentioning is Web3, a technology developed to enable trusted, transparent, and secure interactions, which is of critical importance for financial apps.

FinTech companies continuously innovate and introduce new financial products and services to meet evolving consumer needs, for example, calling a taxi, booking mobile services, buying goods directly from sellers or on the marketplace, as well as tax management. Here are some common types of FinTech apps:

| Type of app | Definition |

| Banking apps | Perform traditional banking activities on mobile devices. |

| Digital wallets/payments | Conduct electronic transactions and support different types of payments. |

| Investment apps | Help users to lend, invest, manage money and investments in one place. |

| Insurance apps | Serve to manage their insurance policies, perform transactions and insurance operations. |

| Neobanks | Digital-only banks that provide traditional banking services. |

| Personal finance management apps | Help users track their expenses, create budgets, and set financial goals. |

| Cryptocurrency apps | Perform management of crypto assets and transactions. |

| Lending apps | Facilitate the borrowing and lending of funds, including application, approval, payment and refund. |

| Currency converter apps | Provide fast and accurate currency exchange at real-time exchange rates. |

| Payment processing apps | Offer seamless transactions and invoicing, point-of-sale systems, and online payment gateways. |

| Regtech apps | Help financial institutions comply with regulatory requirements and automate compliance processes, monitoring, and reporting. |

Common features of a FinTech mobile app

FinTech mobile apps are designed to provide users with convenient and secure access to financial services. Here are common features:

1. Registration and onboarding – users can set up and manage their profiles, including personal information, financial goals and preferences.

2. Account management – users can add payment card details, check their real-time account balance and see the full transaction history. Multi-currency accounts allow them to manage accounts in different currencies.

3. Payments – users can make different types of payments, including transfers to other users, bills, NFC, QR code-based and other digital payments.

4. Customer support – communication with users is carried out via a chatbot, an FAQ section and other helpful resources. With multilingual support, it’s possible to expand the audience and improve communication.

5. Security measures include fingerprint or facial recognition for secure login, two-factor authentication and data encryption.

6. Expense tracking – users can categorize and track their spending, set budget goals and receive alerts when they exceed budget limits, as well as get insights on their spending patterns and financial habits.

7. Notifications and alerts – users can get security alerts on any suspicious activities or login attempts. They can also get notifications about transactions, receipt of funds, account updates, and important announcements.

8. Dashboards – to visualize different types of data. Users can see graphs and charts, filter and sort data.

More specific features depend on the type of financial services you aim to provide and the needs of your target audience. For example, the withdrawal function enables users to see a payment log, payment number, where the money came from, date and time of the transaction, and the current status. The app can offer a document repository, enabling users to attach electronic documents and create a document checklist.

Technologies to develop a FinTech mobile app

Cloud technologies empower the development of scalable, flexible, secure, and cost-effective solutions. Leading cloud service providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, offer specialized tools and services tailored to the unique needs of the FinTech industry. These include computing, virtual machines, storage, analytics tools, databases, AI and Machine Learning.

Chatbots

Chatbots have long been an important component of apps. They significantly improve the user experience and in-app interactions. A bot can serve as a personal financial assistant available round-the-clock that performs a number of tasks, including providing information about account balances and recent transactions, financial insights, recommendations and other useful information; it can perform transactions such as transferring funds and paying bills, assists in user onboarding and verification, and sends alerts and notifications.

Adding AI to a chatbot allows you to dramatically improve its functionality, making interactions more conversational and user-friendly. In addition, when the bot can understand and respond in various languages, it increases the app’s availability. It’s important to keep communication between the user and the chatbot secure. For this purpose, follow clear privacy policies and use end-to-end encryption to protect sensitive information against unauthorized access.

APIs

APIs facilitate seamless data exchange between different systems and components. FinTech apps get access to external services and databases and extend their functionalities. There are several categories of APIs. For example, payment APIs allow apps to accept credit card payments, perform online payments and facilitate money transfers. APIs make it possible to connect with banks to access account information, verify account balances, and facilitate fund transfers.

Also, one can find APIs for identity verification, credit scoring, Blockchain, fraud prevention, tax, investment and trading, currency exchange and many others. When selecting an API, you should consider factors such as security, compliance, documentation, and the specific needs of your app. Additionally, it’s important to stay updated on API changes to ensure your app still complies with relevant regulations.

Data security

FinTech apps must implement robust security measures to protect users’ data, prevent unauthorized access, and comply with regulatory requirements. Some security measures include encryption for both data in transit and data at rest; multi-factor authentication or biometric authentication for users, including creation of strong passwords; regular data backups, API security, regular security audits to identify vulnerabilities and potential threats; monitoring and logging systems to detect unusual activities, potential security incidents and other issues.

Also, security is a concern for all third-party vendors, such as cloud providers, payment gateways, and other services you use for your app. They should follow strong security measures and comply with high standards. In addition, you should be aware of all changes and innovations in the legal and regulatory requirements for data security in the financial technology industry.

Artificial Intelligence

AI can be used in FinTech apps in several ways. It brings intelligence, enhanced efficiency and a more personalized user experience. AI algorithms analyze large amounts of data in real-time, in particular transactions and user behavior, to detect anomalies and identify potentially fraudulent activities; user spending patterns, investment history, and financial goals, to provide personalized recommendations for budgeting, saving, and investing; as well as transaction history, social behavior, and alternative data sources, to assess creditworthiness and calculate risk.

Chatbots empowered with Natural Language Processing provide better customer support, responding to queries and assisting users in financial activities. AI-based voice or facial recognition can be used for secure and convenient user authentication and for payment authorization. Technology can also streamline the customer onboarding process by extracting information from documents, verifying users’ identity, and automating KYC (Know Your Customer) procedures. When using AI for your fintech app, you should keep in mind data security and privacy, and also the potential for bias and mistakes when processing data.

Regulations for FinTech apps

FinTech apps are subject to a variety of regulations and compliance standards to ensure security, privacy, and respect for user rights. There are both global and country-specific regulations that cover financial transactions, data privacy and security, prevention of illegal activities, lending practices, operational resilience and other aspects related to financial activities and technologies. Violation of regulations can lead to fines and sanctions and losing your users’ trust. We can’t list them all, so here are some basic regulations for FinTech apps:

- Know Your Customer (KYC)

Any FinTech project should comply with KYC regulations, an acronym that implies verifying each user’s identity. Verification takes place when a user creates an account and then can handle it in an ongoing manner. This is necessary to identify cases of money laundering, terrorist financing and other financial crimes. KYC measures include collecting and checking out information. In addition, you can analyze the user’s actions while filling out the form, to identify suspicious patterns. To simplify the process for users you can, for example, implement shorter, multi-step forms and easier transfer of sessions between devices.

- Anti–Money Laundering (AML)

Key components of AML are risk assessment, Know Your Customer, customer due diligence, transaction monitoring, suspicious activity reporting, and recordkeeping of all customers and transactions. These regulations require continuous monitoring of users’ financial activities to detect and prevent crimes. In addition, during registration the app should conduct screening for adverse media, global sanctions and watchlists.

- GDPR

GDPR is a standard regulation for any app that handles users’ personal data. In the case of FinTech apps, this includes sensitive financial data such as credit card numbers, bank accounts, and credit scores. Compliance with GDPR guarantees data privacy and protection. You should follow robust data security measures in terms of collecting, processing and storing personal data.

- Payment Card Industry Data Security Standard (PCI DSS)

PCI-DSS governs credit card payments and ensures all transactions are processed safely and securely. It outlines the following areas for compliance: a secure network, secure cardholder data, vulnerability management, access control, network monitoring and testing, and information security. If your app accepts credit cards for various tasks, following this regulation is mandatory.

- Open banking regulations

Open banking refers to a system where financial institutions provide third-party developers with access to their customers’ financial data and services through APIs. In practice, it means that if your app provides personal financial services, you need API to access customer banking data. But what is important is that the customer’s permission is mandatory. Regulations indicate how APIs should handle data and interact with users, and ensure their security, reliability and respect for user privacy. Furthermore, they vary across different countries, and you should check them for each country your app operates in.

Final words

The FinTech industry has shown exponential growth in revenues and investments. However, 2022 was a challenging year, with a slowdown in investments and job cuts. But now experts, including McKinsey, claim FinTech has entered the maturity stage, which means holding steady without sudden drops:

- FinTech will continue to benefit from the radical transformation of the banking industry, rapid digital adoption, and e-commerce growth around the world, particularly in developing economies.

- FinTech still has room to achieve further growth in an expanding financial-services ecosystem.

- FinTech apps in certain verticals and at particular stages of growth are more resilient than their peers.

All in all, the FinTech market is expected to remain dynamic and innovative, with new solutions and services emerging to meet evolving consumer needs.

DigitalMara has expertise and experience in developing FinTech solutions of different types, scope and complexity. Besides full-cycle development, our team conducts compliance research for you, to ensure your project aligns with all industry standards and regulations. We leverage the latest technologies to create apps that redefine the way people interact with financial services.

Choose our custom software development or team augmentation services to transform your innovative ideas into cutting-edge financial solutions.